CERTAIN appeals by ratepayers against the hike in the annual assessment tax will be entertained with deduction given, says state executive councillor Jagdeep Singh Deo.

The Penang Local Government, Housing, Town and Country Planning Committee chairman said the state government would consider on the deductions only on reasonable objections after a hearing session.

He, however, did not reveal the amount of deduction to be given out but merely stated that this would be applicable to only certain cases.

“I am not saying that it applies to everyone but to those with valid reason.

“Currently, we are in the midst of collecting the objections with its last appeal date on Oct 14.

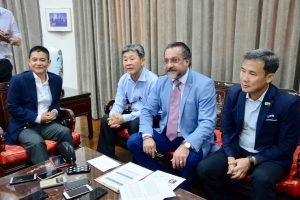

“Notices to the property owners in the state have already been sent out,” he said at a press conference after attending an assessment rate briefing session at Penang Chinese Chamber of Commerce (PCCC) in Light Street today.

He said ratepayers have been given ample time to submit their appeal until Oct 14.

The session, which was organised by PCCC, saw the attendance of various stakeholders in the state.

It was aimed at getting their input and feedback on the rate adjustment.

Representatives from Penang Island City Council (MBPP) and Seberang Perai City Council (MBSP) were present to brief the stakeholders.

Jagdeep reiterated that the adjustment was still the lowest in the country compared to other states.

“Some other states are also in the process of reviewing their rates. It will make their rates higher than ours after the adjustment,” he said.

He added that the state would certainly “hear everyone out” in reference to the people’s grouses.

“Everyone has the right to be heard in accordance with the law,” he stressed.

PCCC president Datuk Seri Hong Yeam Wah said the tax increase should be done gradually.

He said the state, however, did take the plight of the B40 group into consideration while reviewing the new tax.

Earlier, PCCC vice-president Datuk Finn Choong, acting as a moderator in the session, hoped the event would help the attendees understand more about the issue.

Story by Edmund Lee

Pix by Law Suun Ting