THE Penang Island City Council (MBPP) has explained that the annual assessment tax is dependent on the annual rental value of the property.

MBPP mayor Datuk Yew Tung Seang said while it was a requirement for the council, under Section 137(3) of the Local Government Act 1976, to review the assessment tax every five years, the MBPP has not been doing so since 2005.

“Due to certain reasons, the review was delayed for 15 years.

“We have decided to review the assessment tax, which will be effective on Jan 1 next year (2020),” Yew told a press conference after the council meeting at the City Hall this morning.

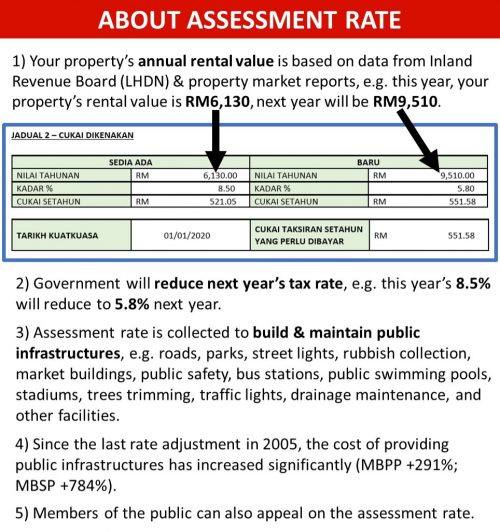

Yew quoted an example of the assessment tax of a medium-cost apartment in Sungai Dua.

“Back in 2005, the annual rental value (nilai tahunan) of the property was RM5,150 which was equivalent to about RM429 rental value per month.

“Fifteen years later (2020), the annual rental value of the same property is reviewed. The annual rental of the property is valued at RM8,140 which is equivalent to about RM678 rental value per month.

“Property owners have to understand that the review of the annual rental value of their property affects the assessment tax,” he said.

Yew added that the MBPP was concerned about the increase in assessment tax; and had therefore lowered the percentage of the assessment rate (kadar %) for the year 2020.

“We have 17 types of property on the Penang island which include industries, SOHO, commercial complexes, hotels, residential apartments, residential landed properties, and others. The percentage of the assessment rate differs according to the types of property.

“The MBPP has lowered the percentage of the assessment rate for 16 types of property, except one,” he said.

The percentage of the assessment rate for associations or kongsi remained at 7%.

Referring to his earlier example, he said the annual rental value of the medium-cost apartment in Sungai Dua was RM5,150 in 2005, and the percentage of the assessment rate was 8.5% then.

“However, we have lowered the percentage of the assessment rate to 5.8% for the said property for the year 2020. This is to reduce the impact on property owners as the annual rental of the property is now valued at RM8,140.

“The council obtained the annual rental value of properties from the Inland Revenue Board of Malaysia as well as other usable statistics,” he said.

Yew said that the council would be going to the ground to explain the assessment tax to the public.

“Details on the venues and dates will be announced in our social media soon,” he said.

“We are now collecting data and objections filed by property owners with regard to the assessment tax. They have until Oct 14 to send in their appeals against the new assessment tax,” he said.

Story by Christopher Tan

Pix by Darwina Mohd Daud