WITH the impending Budget 2025 set to be tabled by Prime Minister Datuk Seri Anwar Ibrahim in Parliament this Friday (Oct 18), various groups are urging the Madani Government to address the cost of living and other pressing issues that are straining lower- and middle-income earners.

The government is expected to introduce a budget that tackles the rising prices of essential goods, and other matters related to wage stagnation and economic growth.

Buletin Mutiara conducted a survey across different segments of society to gather their hopes for Budget 2025.

Topton Group founder Tommy Chuah,33, told Buletin Mutiara that the Federal Government should implement and standardise a three percent Goods and Services Tax (GST) rate across all income groups.

“For instance, everyone can share the tax burden rather than targeting just those from the T20 group.

“I understand the Government’s desire to ease the burden on the B40 group, but the needs of the M40 and T20 groups must be considered as well.

“The Government can still channel financial assistance to the B40 group, while this approach helps spur economic growth,” he said.

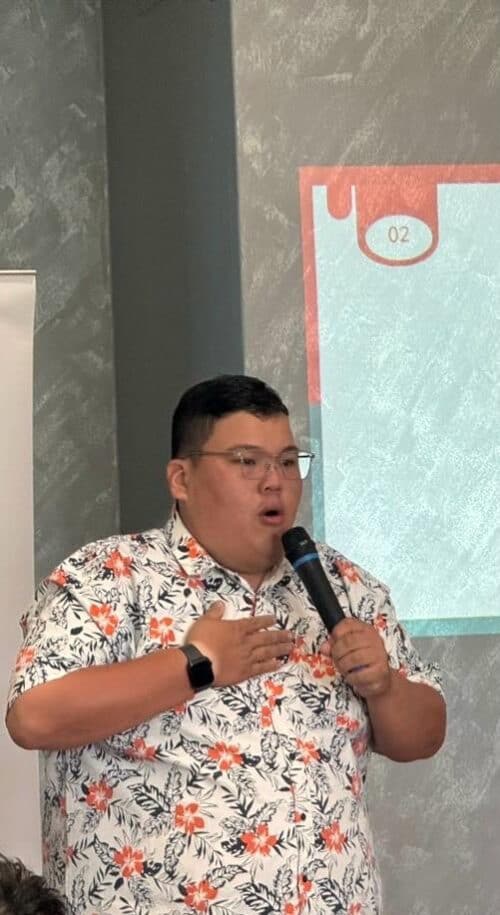

Penang Island City Council (MBPP) councillor Benji Ang suggested that the Federal Government establish a foundation to provide grants for cultivating influencer marketing.

“This will allow interested youths to pursue influencer marketing as a full-time career to promote local products and tourism, thereby elevating our country on the global stage.

“The government should be proactive in encouraging young people to follow their passions, enabling them to develop their ideas and showcase their skills without being burdened by financial concerns,” he said.

Civil servant Mastura Zakaria expressed optimism that the government would protect the rights of those under Contract For Service (CFS).

“Some of us have been serving the civil service sector under CFS for more than 15 years, without any improvement in staff welfare.

“We hope the Government can address this,” she said.

Auditor R. Selvam, 32, hoped the government would offer more assistance to PTPTN loan defaulters.

“I know various rebates have been provided, but some of us are still struggling with financial commitments,” he said.

Story by Edmund Lee

Pix courtesy of interviewees